Our Frost Pllc Statements

Table of ContentsGetting The Frost Pllc To WorkThe Buzz on Frost PllcLittle Known Facts About Frost Pllc.8 Simple Techniques For Frost Pllc

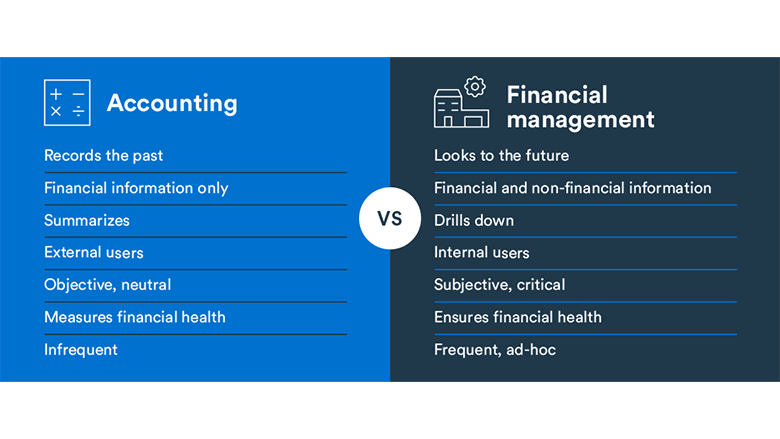

When it involves financial solutions, there are various sorts of firms available to pick from. 2 of one of the most typical are accounting firms and CPA companies. While they may appear comparable on the surface, there are some vital differences in between the two that can affect the kind of services they provide and the certifications of their personnel.Among the crucial distinctions between accounting firms and CPA firms is the credentials needed for their staff. While both kinds of firms may use bookkeepers and various other economic specialists, the second one call for that their staff hold a CPA license which is granted by the state board of accountancy and calls for passing an extensive examination, meeting education, and experience needs, and adhering to rigorous honest standards.

While some may hold a bachelor's level in bookkeeping, others may have only finished some coursework in audit or have no formal education in the area in all. Both bookkeeping companies and certified public accountant companies provide a variety of financial solutions, such as accounting, tax prep work, and economic preparation. There are considerable distinctions between the services they supply.

These regulations might include needs for continuing education and learning, moral criteria, and quality assurance treatments. Bookkeeping firms, on the other hand, may not undergo the exact same degree of policy. Nonetheless, they might still be called for to stick to particular requirements, such as usually approved accountancy concepts (GAAP) or global financial coverage requirements (IFRS).

All About Frost Pllc

These services may include tax planning, audit solutions, forensic accounting, and critical data-driven analysis (Frost PLLC). The range of services used by certified public accountant companies can differ significantly relying on their size and focus. Some might specialize entirely in audit and assurance services, while others might offer a larger series of solutions such as tax obligation preparation, enterprise risk administration, and consulting

Additionally, certified public accountant companies may concentrate on offering particular industries, such as medical care, financing, or realty, and customize their solutions appropriately to fulfill the one-of-a-kind requirements of clients in these markets. Finally, there are differences in the fee frameworks of bookkeeping firms and certified public accountant firms. Accountancy firms might bill per hour prices for their services, or they may provide flat costs for specific tasks, such as accounting or economic statement preparation.

Elderly Manager and Certified Public Accountant with over 20 years of experience in accountancy and economic solutions, specializing in threat administration and regulatory compliance. Knowledgeable in handling audits and leading groups to supply exceptional solutions. The Difference Between a CPA Firm and an Audit Company.

Some Ideas on Frost Pllc You Need To Know

Several accounting firm leaders have established that the conventional collaboration design is not the method of the future. At the exact same time, investor interest in specialist services firms is at an all-time high.

All prove services are performed only by the CPA company and supervised by its owners. The CPA company and the solutions company enter into a services arrangement, pursuant to which the solutions firm might provide expert personnel, office, equipment, technology, and back-office features such as billing and collections. The CPA firm pays the services business a cost for the solutions.

The adhering to are a few of the essential considerations for CPA firms and financiers contemplating the development of an alternative technique structure. CPA solid ownership demands are developed in part to shield prove services and relevant judgments from market stress. That means a CPA company giving confirm services need to remain a different legal entity from the straightened services business, with best site distinctive governing documents and governance frameworks.

The lower line is that parties to an alternative technique framework need to meticulously examine the applicable freedom programs and implement controls to keep track of the certified public accountant company's freedom - Frost PLLC. Most alternate practice structure transactions entail the transfer of nonattest engagements and relevant data. Parties should consider whether customer authorization is required and ideal notice even when authorization is not called for

The 6-Minute Rule for Frost Pllc

Frequently, any kind of type of retirement arrangement existing at the certified public accountant firm is terminated about the transaction, while puts and calls might be appropriate to companion owned equity in the solutions company. Connected to the economic factors to consider, CPA companies require to take into consideration exactly how the following generation of company accountants will be compensated as they attain seniority that would usually be accompanied by collaboration.

Both capitalists and CPA firms will certainly require to balance the contending interests of preventing dilution while correctly incentivizing future firm leaders. Capitalists and certified public accountant firms need to address post-closing governance matters in the solutions firm. A financier considering a control investment (and linked governance) in the services business must consider the expanded reach of the auditor independence policies in that circumstance as compared to a minority financial investment.

Comments on “Some Known Details About Frost Pllc”